Liquidity management is crucial for businesses to maintain financial stability and seize opportunities. Through strategic tracking of cash inflows and outflows, companies can predict future needs and make informed financing decisions, including accessing equipment loans to acquire essential assets without compromising overall liquidity. Equipment loans provide immediate cash flow, enabling firms to tap into asset value, reinvest in operations or growth, and act as a safety net during economic downturns. Proactive cash flow management through equipment financing fosters long-term business sustainability and competitiveness by enhancing liquidity management.

Equipment loans offer a strategic solution for businesses aiming to streamline cash flow and enhance liquidity management. This article delves into the art of proactive cash flow management, exploring how equipment financing can provide much-needed capital while improving financial flexibility. We’ll uncover the benefits of maintaining strong liquidity, delve into effective utilization strategies, and understand the pivotal role these loans play in fostering sustainable business growth.

- Understanding Cash Flow and Liquidity Management

- The Role of Equipment Loans in Enhancing Cash Flow

- Benefits of Proactive Cash Flow Management

- Strategies for Effective Equipment Loan Utilization

Understanding Cash Flow and Liquidity Management

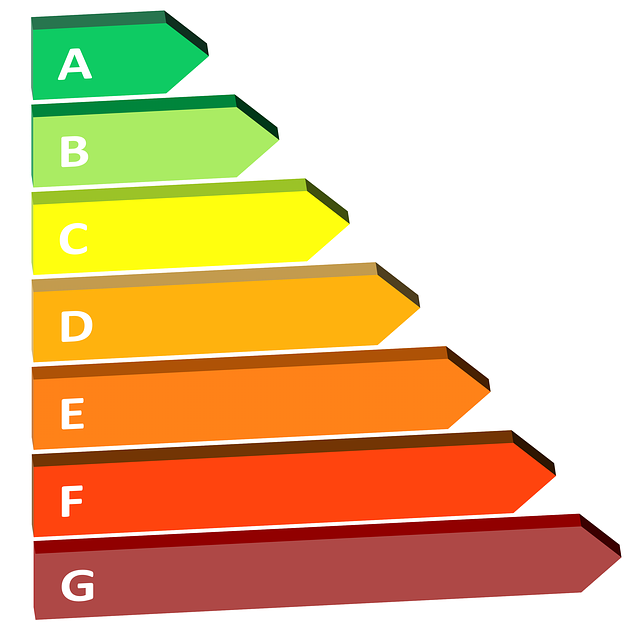

Cash flow is the lifeblood of any business, representing the movement of money in and out over a specific period. Effective liquidity management involves understanding and predicting these cash flows to ensure businesses have enough funds to cover short-term obligations and opportunities. By keeping a close eye on cash inflows and outflows, companies can proactively manage their financial health.

Equipped with this knowledge, businesses can make informed decisions about equipment financing and loans. For instance, accessing equipment loans allows organizations to acquire necessary assets without disrupting their liquidity. This strategic approach enables seamless operations, as businesses can plan and budget for significant purchases while maintaining a healthy cash reserve.

The Role of Equipment Loans in Enhancing Cash Flow

Equipment loans play a pivotal role in enhancing cash flow for businesses, particularly those operating with significant capital investments in machinery and tools. By providing access to immediate liquidity, these loans offer a strategic solution for proactive cash flow management. Instead of waiting for sales or projects to generate revenue, businesses can tap into the value of their equipment, allowing them to inject funds directly back into operations or invest in growth opportunities.

In times of economic uncertainty or unexpected cash crunches, equipment loans provide a safety net. Businesses can secure the necessary capital to meet immediate financial obligations, maintain workforce stability, and continue day-to-day operations seamlessly. This proactive approach to liquidity management ensures that companies remain agile and responsive to market changes, fostering long-term sustainability and competitiveness.

Benefits of Proactive Cash Flow Management

Proactive cash flow management offers significant advantages for businesses aiming to optimize their financial health and sustainability. By anticipating and managing cash inflows and outflows, companies can gain a powerful tool for liquidity management. This proactive approach ensures that funds are available when needed, covering operational expenses, investments, or unexpected costs without the stress of last-minute financial strain.

It fosters stability by reducing the risk of cash flow shortages or surpluses, enabling businesses to make informed decisions regarding investments, expansions, or cost-cutting measures. Effective liquidity management through proactive cash flow strategies can also enhance a company’s creditworthiness and negotiating power with lenders and suppliers, further contributing to long-term financial success.

Strategies for Effective Equipment Loan Utilization

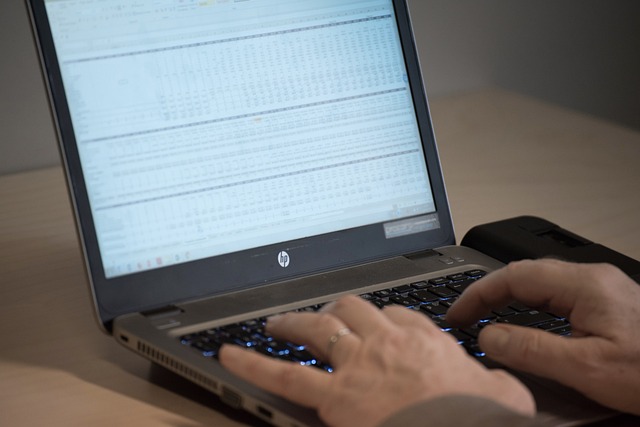

To maximize the benefits of equipment loans for proactive cash flow management, businesses should employ strategic approaches that enhance liquidity management. Firstly, identifying critical equipment with high residual value ensures focused investment. By prioritizing assets that can significantly contribute to operational continuity and future resale potential, companies can optimize their loan terms and interest rates. This strategic selection process enables better financial planning by aligning equipment acquisition with specific business objectives.

Additionally, implementing robust maintenance and monitoring programs is vital for effective utilization. Regular upkeep and predictive analytics can extend the lifespan of equipment, reducing replacement costs and enhancing overall efficiency. Moreover, close tracking of loan repayments and cash flow projections allows businesses to anticipate potential liquidity challenges, facilitating timely adjustments in financial strategies. Such proactive measures ensure that equipment loans remain a powerful tool for managing cash flow dynamics, ultimately supporting sustainable business growth.